closed end loan disclosures

Along with APR disclosures the disclosure of the finance charge is central to the uniform credit cost disclosure envisioned by the TILA. If the creditor has not sold or transferred the debt to a collection agency the charged off account still will report the balance owed.

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

Mortgage loans that includes virtually all closed-end subprime loans secured by a consumers principal dwelling.

. The Closed School WeeklyMonthly Reports CSMR are the official lists that guaranty agencies may use to discharge loans for students who meet the eligibility requirements under 34 CFR Section 682402d of the Federal Family Education Loan Program regulations. 25 Per transaction. Borrow for what you need on your terms.

The disclosures required by 102637 are required to reflect the terms of the legal obligation between the parties and if any information necessary for an accurate disclosure is unknown to the creditor the creditor shall make the disclosure in good faith based on the best information reasonably available to the creditor pursuant to 102617c and. Payment example based on the terms above. Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report.

Miscellaneous Account and Service Fees Schedule - Advisory Stop Payment. Closed-end funds frequently trade at a discount to their net asset value NAV. The revisions also applied new protections to mortgage loans secured by a dwelling regardless of loan price and required the delivery of early disclosures for more types of transactions.

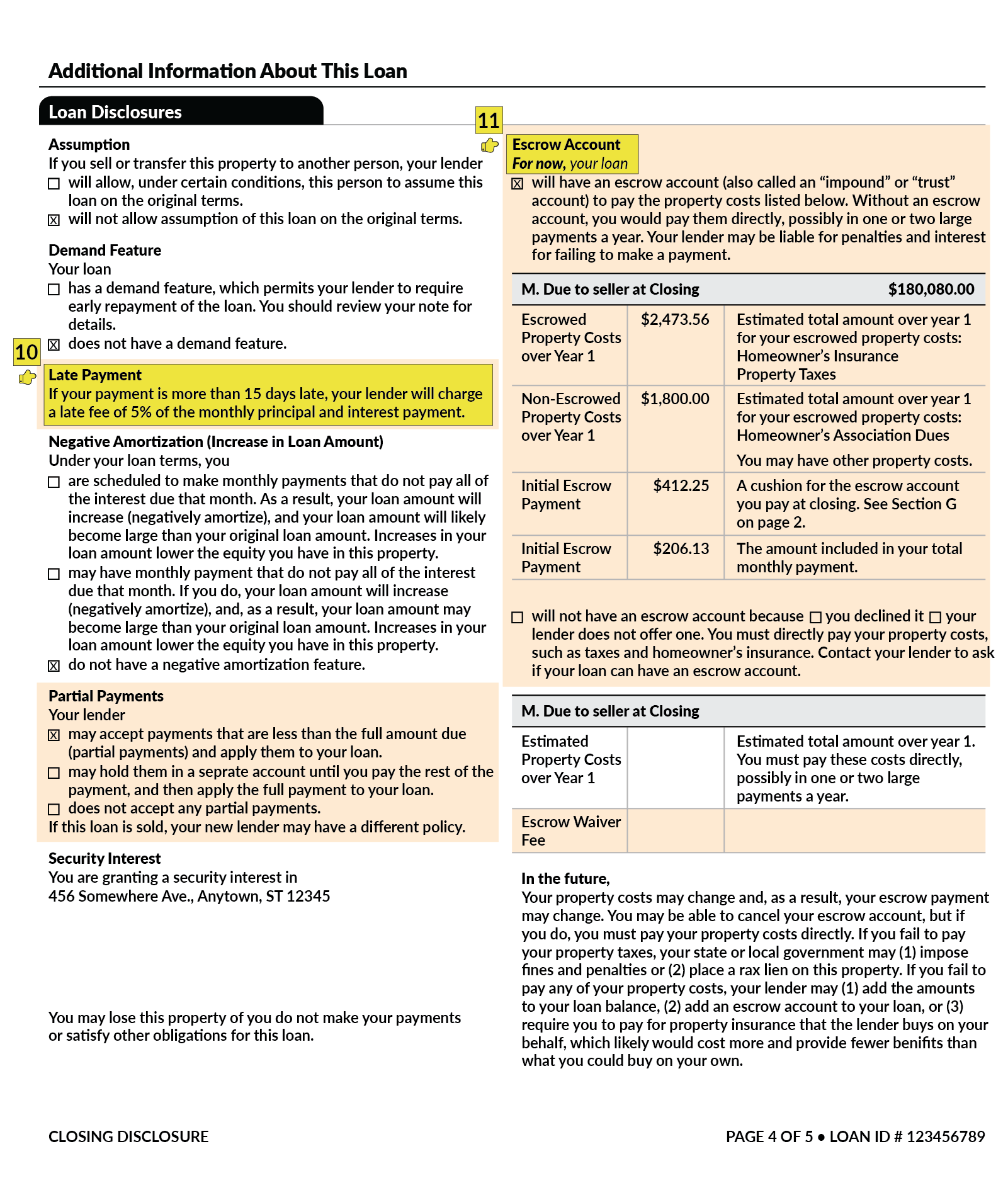

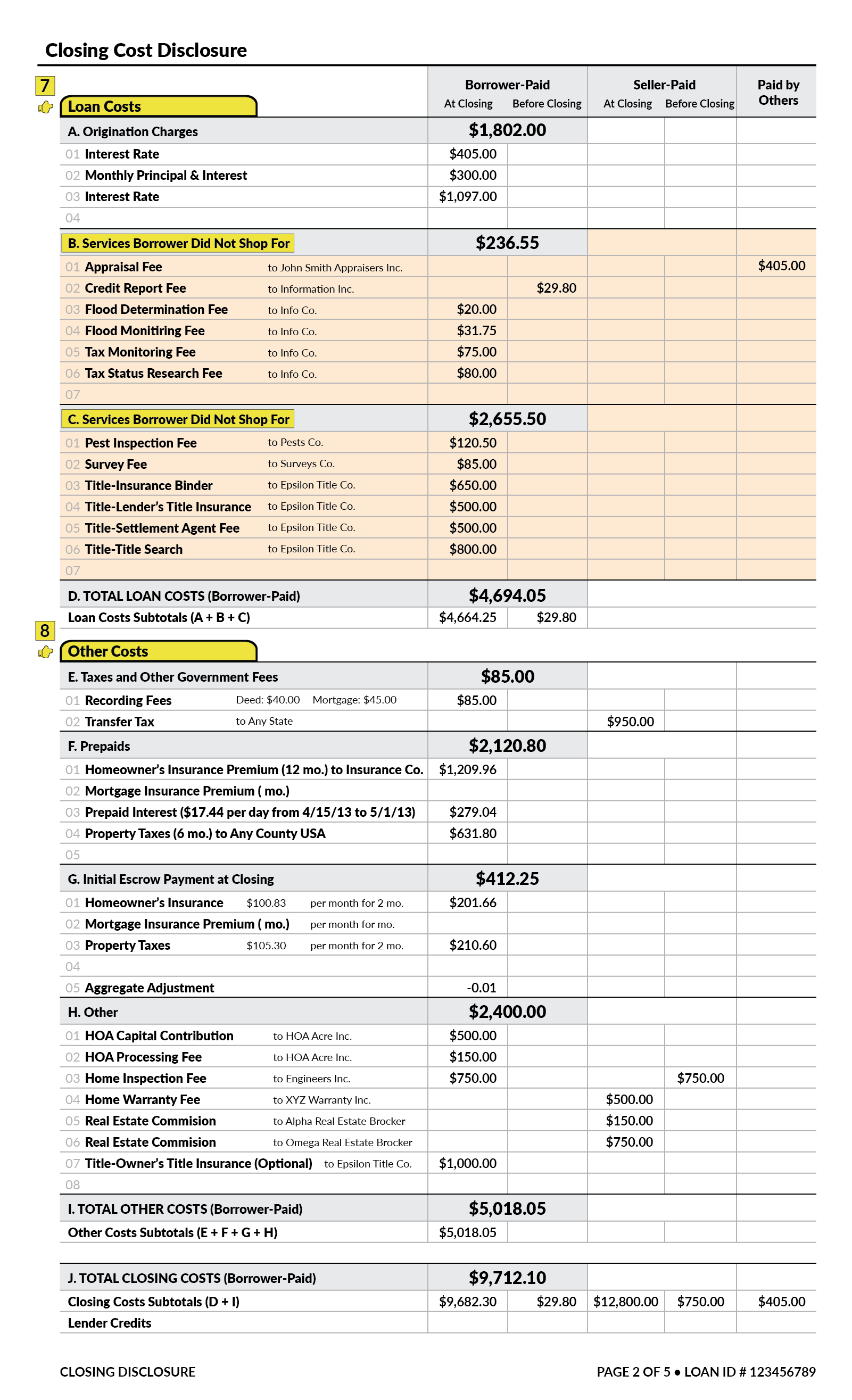

The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages. For additional information please contact your investment professional. 35 Per transaction.

They can afford the loan and to compare the cost of different loan offers including the cost of the loans over time. Home equity lines of credit reverse mortgages or mortgages secured by a mobile home or by a dwelling that is not attached to real. We would like to show you a description here but the site wont allow us.

Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie. From consolidating debt to paying for unexpected expenses to taking out a personal loan for home improvements discover the benefits of a Teachers Credit Union Personal Loan. The revisions also banned several.

Asset-Based Lending PDF Closed-End Transaction PDF General Factoring PDF Lease Financing PDF Open-End Credit Plan PDF Sales-Based Financing PDF 120418 PRO 0118 California Financing Law CFL Commercial Financing Disclosures Comment Period Ends. Dear TYC Paying a closed or charged off account will not typically result in immediate improvement to your credit scores but can help improve your scores over time. An investment in this fund presents a number of risks and is not suitable for all investors.

Its possible to qualify for a car loan even if you have bad credit but having a good credit score is important if you want to qualify for a low interest rate. Shares of closed-end funds are subject to investment risks including the possible loss of principal invested. Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund.

Brought to you by Copyright 2022 All Rights Reserved. Equities including Closed-end Funds 9 9. 1 See account agreements.

Closed School WeeklyMonthly Reports. Generally the finance charge includes any. Estimated monthly payment for auto loan of 20000 at 249 APR for 50 months is 42152.

And if youre hoping to score a 0 APR car loan youll likely need a very good or exceptional FICO Score which means a score of 740 or above. Creditors may make several types of changes to closed-end model forms H-1 credit sale and H-2 loan and still be deemed to be in compliance with the regulation provided that the required disclosures are made clearly and conspicuously. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit.

Finance Charge Open-End and Closed-End Credit 2264 The finance charge is a measure of the cost of consumer credit represented in dollars and cents. Per transaction Per transaction. Per transaction Unit Investment Trusts.

Paying Off a Charged Off Account. Copyright 2022 All Rights Reserved. Lowest loan rate at 224 APR financed over 50 month term is for a 2020 model year auto or newer and includes a 25 discount for GAP purchase and a 25 discount for warranty purchase.

Models H-1 and H-2.

For Over 35 Years Oak Tree Has Provided Lending Documents Forms And Disclosures For Credit Unions In All Federal Student Loans Credit Union Business Systems

Infographic The Loan Process Simplified Mortgage Infographic Mortgage Lenders Refinancing Mortgage

What Is A Closing Disclosure Lendingtree

Sign The Closing Disclosure Cd Mortgagemark Com

Closing Your Loan Account Do These Things First

What Is A Closing Disclosure Lendingtree

Have You Heard The News Credit Union Lending Is On The Rise According To The Latest Federal Reserve Repo Home Equity Credit Union Marketing Home Equity Line

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)